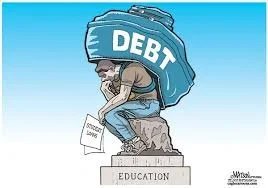

How the “Big Beautiful Bill” Burdens Low-Income Students and Grads

When President Trump signed the “One Big Beautiful Bill” on July 4, a lot of people saw the headlines and kept it moving. But what didn’t make the highlight reel was how this new law quietly pulled the rug out from under millions of students — especially low-income students and those trying to continue their education.

For many first-generation and working-class students, federal loans are the only path to a degree. But the new law repeals the Biden-era SAVE Plan — a program that allowed borrowers to make affordable payments based on their income, often as low as $0, with loan forgiveness after 10 or 20 years. Now, those flexible options are gone.

Instead, interest will accrue faster, payments will be higher, and debt will linger longer. With no cap on interest growth, a missed payment could turn into a snowballing balance — even if the borrower is actively trying to repay.

The bill also slashes borrowing options for graduate students. It raises interest rates and tightens loan caps, especially for fields that aren’t considered “high-earning” — like education, journalism, public service, or social work. Many students in those fields will now have to piece together private loans or work multiple jobs to cover costs.

And for those hoping to work in public service — where salaries are already modest — there’s more bad news: the Public Service Loan Forgiveness (PSLF) program is being phased out. Students enrolling after Jan. 1, 2026, won’t be eligible, effectively closing the door on one of the few safety nets for graduates who dedicate their careers to helping others.

According to the Center for Student Borrower Relief, the bill could force over 1.7 million Texans off Medicaid and SNAP — but the long-term academic impact may be even more profound.

“The big takeaway is that borrowers are going to have fewer options to repay their student loans and they’re going to be paying more, and in many cases, much longer,” said Abby Shafroth, Managing Director of Advocacy at the National Consumer Law Center

The legislation makes no allowances for inflation-adjusted Pell Grants. It also removes subsidies for grad school loans — meaning interest starts building the moment a student enrolls. That means someone earning $35,000 out of grad school could still face a loan balance growing faster than they can pay it down.

Critics say the bill rewards wealth and punishes ambition, creating barriers at every level of the education system.

For low-income and first-gen students, it means tougher decisions: delay school, downsize dreams, or walk into adulthood carrying a loan burden that could take decades to shake.

If this law is meant to reflect American priorities, then we need to ask — what kind of future are we funding? And who gets left behind in the name of “big, beautiful” policy?